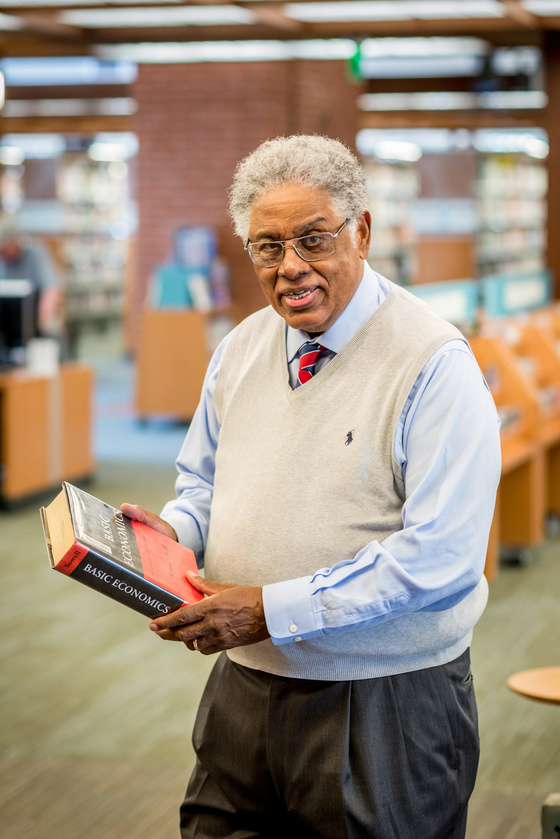

In support of Trickle-Down economics, Thomas Sowell writes:

In 1921, when the tax rate on people making over $100,000 a year was 73 percent, the federal government collected a little over $700 million in income taxes, of which 30 percent was paid by those making over $100,000. By 1929, after a series of tax rate reductions had cut the tax rate to 24 percent on those making over $100,000, the federal government collected more than a billion dollars in income taxes, of which 65 percent was collected from those making over $100,000.[1]

Sowell gets his history wrong. He is right about the data for 1929, but rather than the highest tax bracket in 1921 being 73% for annual income over $100,000, this rate actually applied for income over $1,000,000.[2] For income over $100,000 that year, the tax rate was 60%, not 73%. The increase in federal income tax revenue was not due to lower income taxes, but a period of prosperity brought about by excessive debt leveraging which would vanish once the Great Depression hit in 1929. This is evident since the number of millionaires in 1918 was only 10,000,[3] compared to 25,000-35,000 in 1929. The stock market created many millionaires, hence more Federal income revenue from the highest bracket, regardless of the tax rate. Also, there were only 67 people who reported income over $1,000,000 in 1918.[4] By 1929 this rose to 504.[5] Sowell also doesn’t mention the Depression of 1920-1921, which further limited the number of people in the highest bracket. This depression wasn’t caused by high taxes, but factors such as high unemployment after the war, the Spanish flu, and the deflation caused by the gold standard.